Do you seek for 'accounts receivable thesis'? You will find questions and answers on the subject here.

Accounts receivable measures the money that customers owe to letter a business for goods or services already provided. Analyzing letter a company's accounts due will help investors gain a amended sense of letter a company's overall commercial enterprise stability and runniness.

Table of contents

- Accounts receivable thesis in 2021

- Accounts receivable vs payable

- Accounts payable vs receivable

- Accounts receivable vs accounts payable

- Accounts receivable turnover

- Accounts receivable definition

- Accounts receivable jobs

- Accounts receivable thesis 08

Accounts receivable thesis in 2021

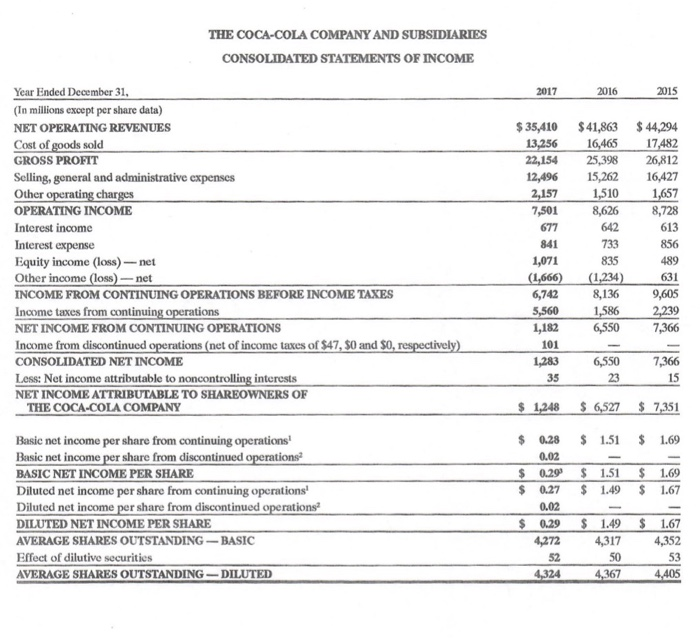

This image shows accounts receivable thesis.

This image shows accounts receivable thesis.

Accounts receivable vs payable

This image representes Accounts receivable vs payable.

This image representes Accounts receivable vs payable.

Accounts payable vs receivable

This picture illustrates Accounts payable vs receivable.

This picture illustrates Accounts payable vs receivable.

Accounts receivable vs accounts payable

This image demonstrates Accounts receivable vs accounts payable.

This image demonstrates Accounts receivable vs accounts payable.

Accounts receivable turnover

This picture demonstrates Accounts receivable turnover.

This picture demonstrates Accounts receivable turnover.

Accounts receivable definition

This picture illustrates Accounts receivable definition.

This picture illustrates Accounts receivable definition.

Accounts receivable jobs

This image illustrates Accounts receivable jobs.

This image illustrates Accounts receivable jobs.

Accounts receivable thesis 08

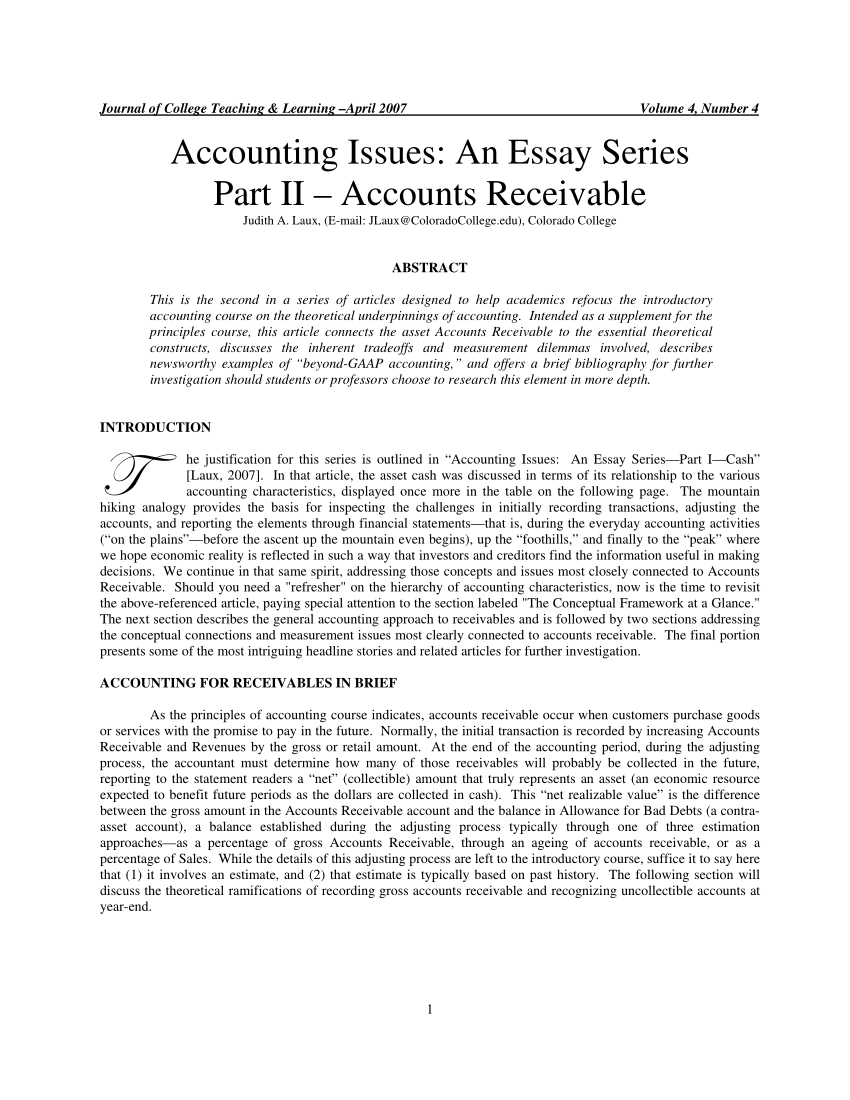

This picture shows Accounts receivable thesis 08.

This picture shows Accounts receivable thesis 08.

What are the barriers to account receivable management?

This thesis has found important barriers in the account receivable management as a part of a business financial strategy. Difficulties arise when considering interdependence and uncertainty, in the internal environment of a business.

What is the purpose of an account receivable thesis?

The purpose of this thesis is to investigate and connect the collection process of accounts receivable to the internal perspective of a balance scorecard, while taking into account the aspects of interdependence and uncertainty.

How are accounts receivables affect the performance of a company?

According to Kakuru (2000), when a company renders a service or sells its goods and does not receive cash for it, the company is said to have granted trade credit to clients. The general objective of the study was to identify the effect of management of accounts receivables on the performance of KOSEL Logistics.

Which is a case study of Accounts Receivable Management?

MANAGEMENT OF ACCOUNTS RECEIVABLES AND ITS EFFECT ON FIRM'S PERFORMANCE: A CASE STUDY OF KOSEL LOGISTICS. MANAGEMENT OF ACCOUNTS RECEIVABLES AND ITS EFFECT ON FIRM’S PERFORMANCE: A CASE STUDY OF KOSEL LOGISTICS.

Last Update: Oct 2021